Background

Urban life in Nigeria reflects the diversity of incomes, lifestyles, and settings across the country.

Around 60% of the urban population falls within a certain income bracket, earning between ₦40,000 ($100) and ₦250,000 ($600) monthly. However, the landscape for low-to-middle-income earners in Nigeria has been evolving rapidly.

Since 2014, there has been over a 60% currency devaluation and a 14% inflation rate. This has shifted priorities for many, prompting questions like, "What can I afford?" taking precedence over "What do I need?" As a result, compromises on food quality often come first, with the wellbeing of children taking top priority in many households.

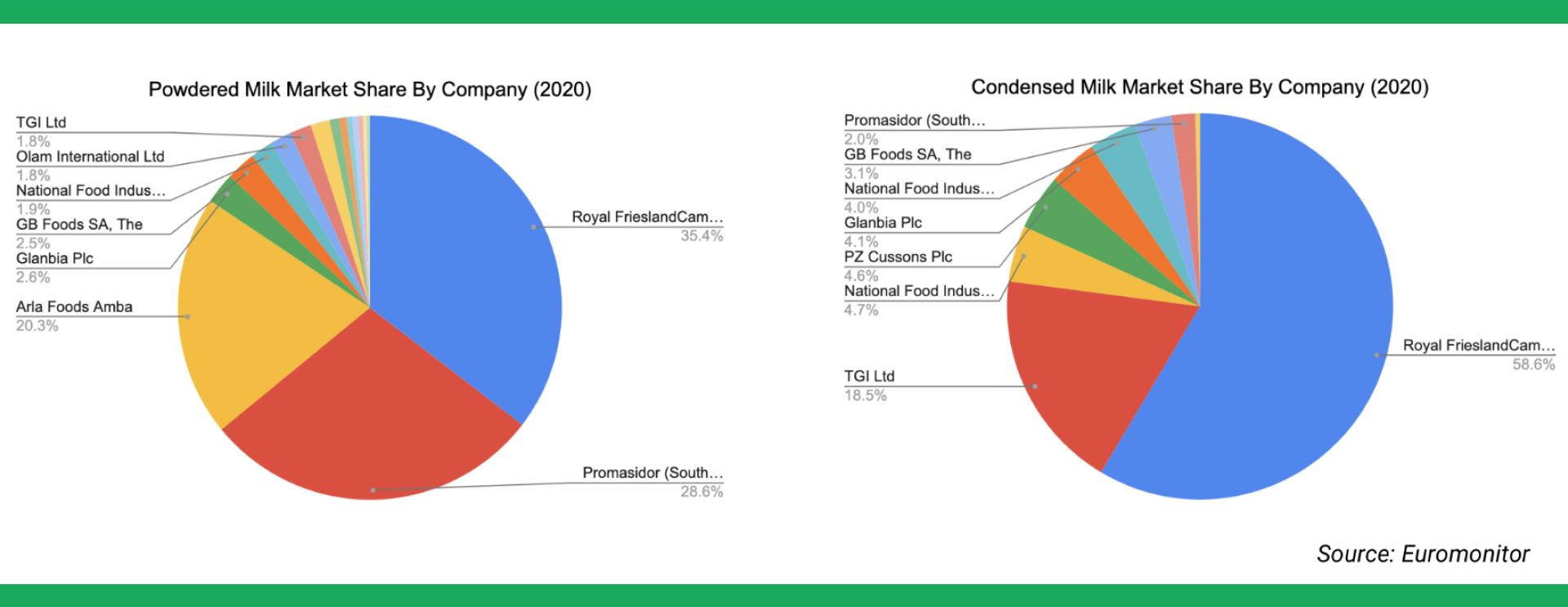

Market Context

There are over 21 companies offering over 27 brands of powdered and liquidmilk to the Nigerian consumer. However, the clear leaders by market share are (Peak) FrieslandCampina, (Cowbell) Promasidor, and (Dano) Arla Foods.

The Challenge

Massive currency devaluation has been a significant issue since 2014, with the exchange rate shifting from $1 being equivalent to NGN150 to $1 being equal to NGN480 at the time of this research. These fluctuations are often in response to changes in oil prices, a critical factor in Nigeria's economy.

Unfortunately, this devaluation means that businesses struggle to realize the full value of their goods when they're sold in Nigerian Naira because they often need to convert these earnings into USD to pay for imports.

With dwindling foreign reserves, the pressure mounts for access to USD, especially for essential imports. To manage this situation, the Central Bank imposed restrictions on accessing dollars for milk imports in 2019, setting the exchange rate at $1 = ₦380.

This policy left dairy companies with little choice but to purchase USD from the parallel market, adding further complexities to their operations.

Noteworthy Tailwinds

In 2020, companies like Nestlé, Promasidor, TGI, Arla, FrieslandCampina, and Integrated Dairies Limited got a pass on forex restrictions.

The government stepped in to boost local production, especially in dairy, aiming to reduce conflicts between farmers and herdsmen. Businesses also benefited from single-digit loans from the Bank of Industry (BOI).

People are increasingly leaning towards products made and adapted locally due to a growing sense of social and national pride. Plus, the rise of Afrobeats culture is influencing consumer choices. Cowbell's "Our Milk" tagline is striking a chord with consumers, reflecting these trends.

Designing for Moms

We are designing for a mother who is likely:

Over 26 years old (90%)

Self-employed (44%) or salaried (40%)

Educated - she has completed higher education (43%)

or at least secondary school (31%)

Purchase Contexts

A clear understanding of who is buying, where they’re buying from, and circumstances surrounding their purchases was helpful in a bid to investigate and understand the rationale behind user preferences.

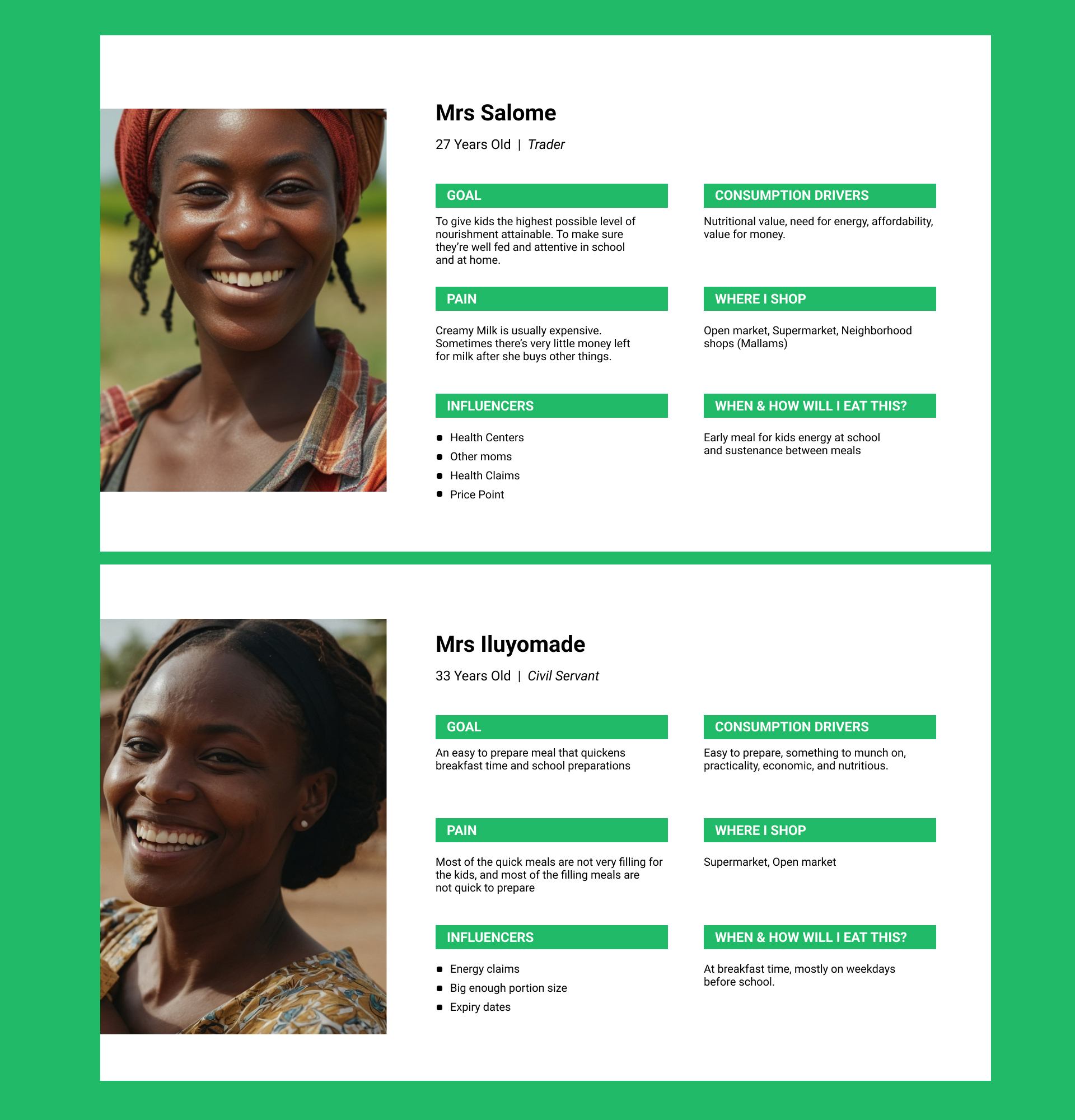

Personas

Collating and sorting the data we gathered from our interviews, we created these personas to best represent our target users.

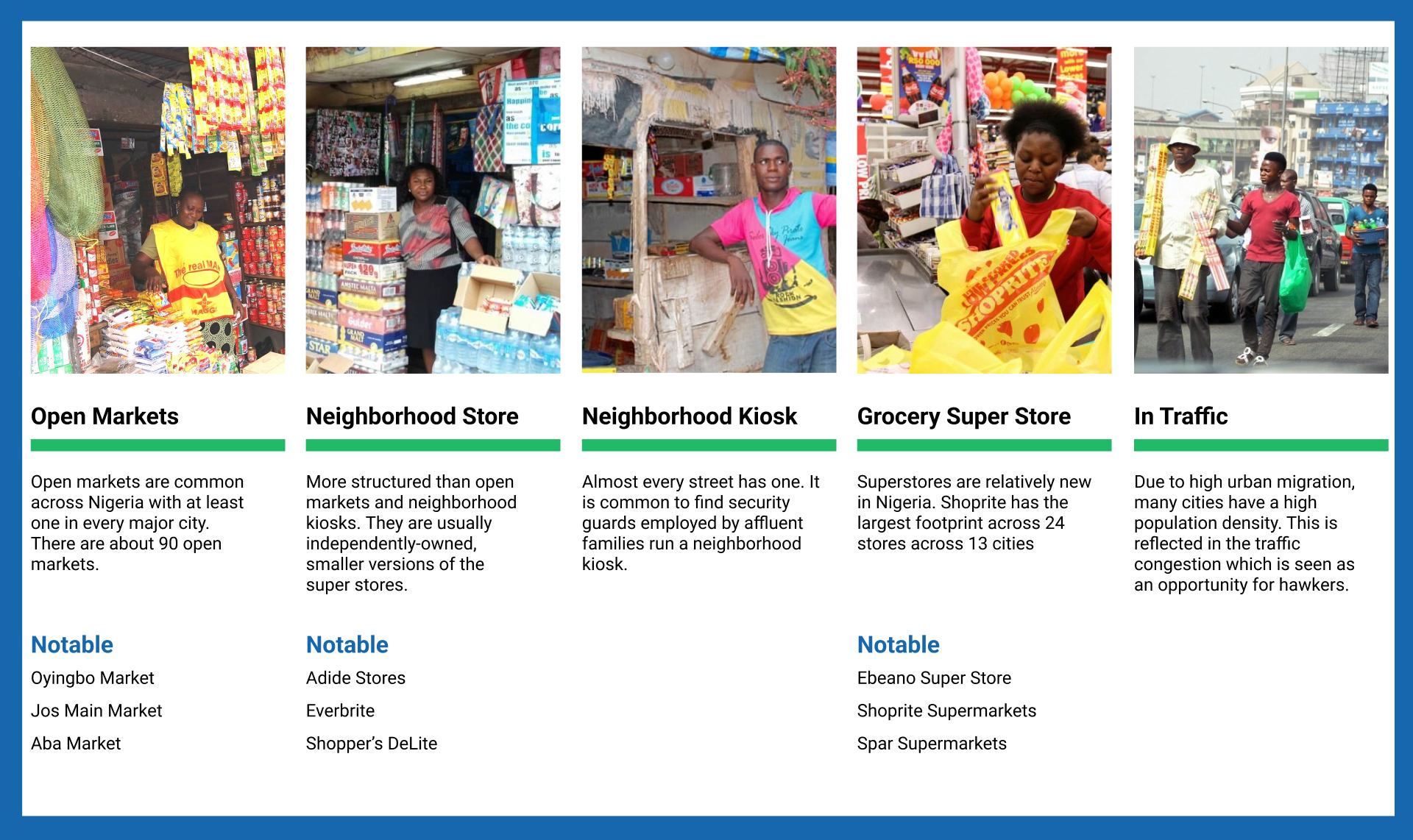

Where do they go to buy?

The search for deeper insights into mothers shopping behaviors led us to explore different places they do their shopping. Understanding where they buy helped us identify pain points, analyze competitor strategies and inform more targeted product decisions further down the line.

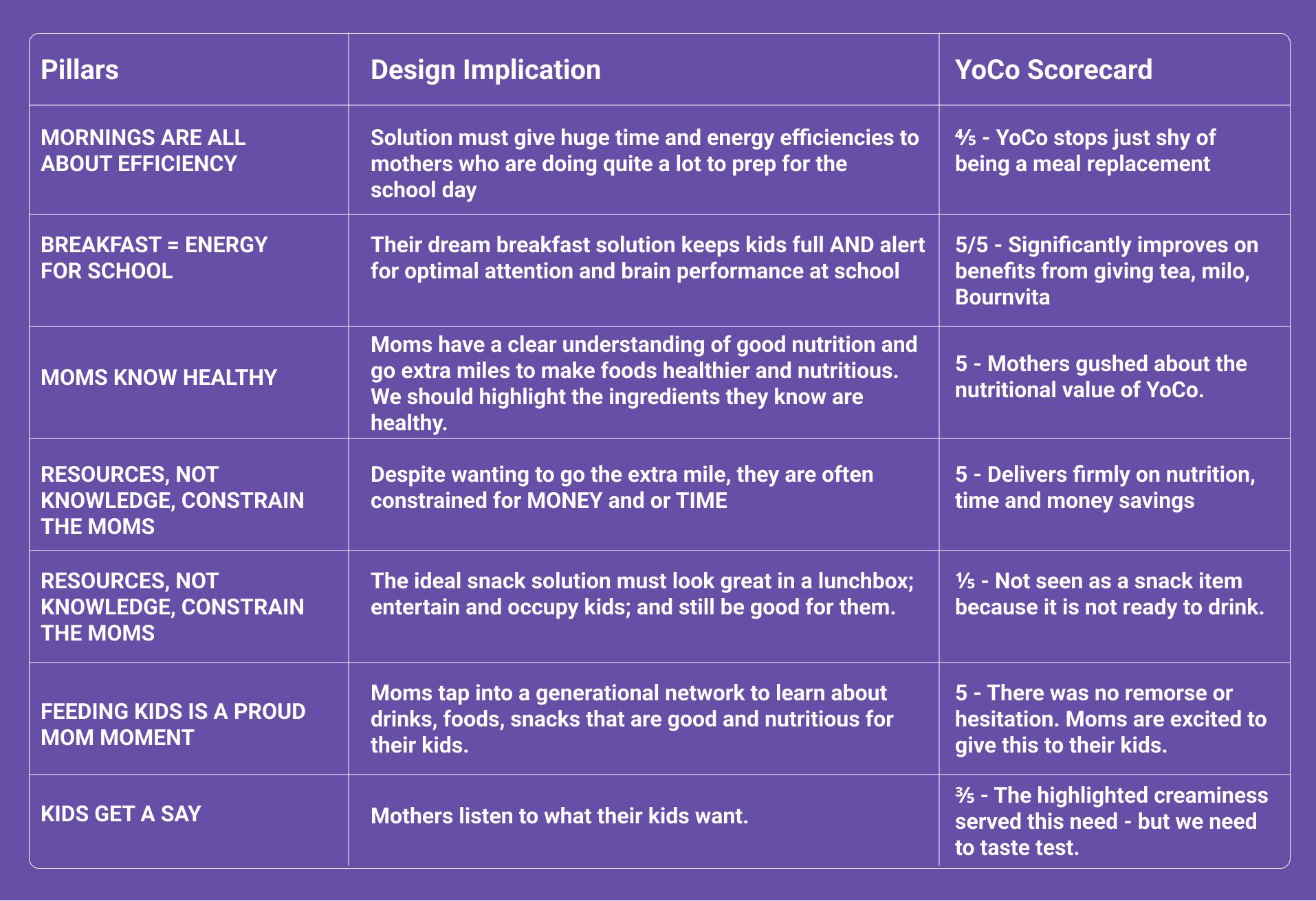

Design Pillars

With the tested and validated concepts, we were able to develop design pillars to guide product development and business strategy.

Design pillars are like guardrails that must be respected in order to deliver on the design challenge.

They are based off the needs and wants that manifested throughout the research and testing process.

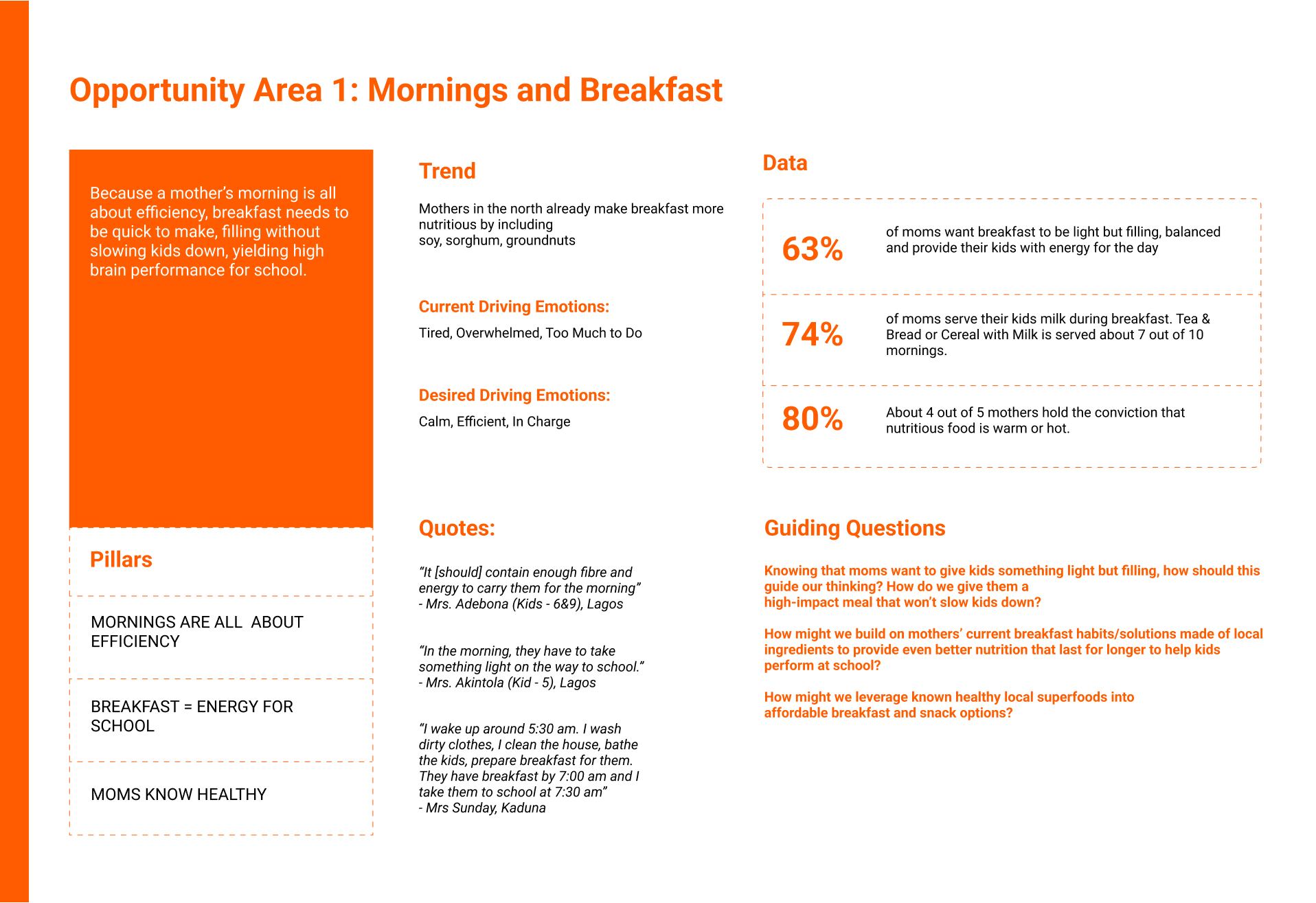

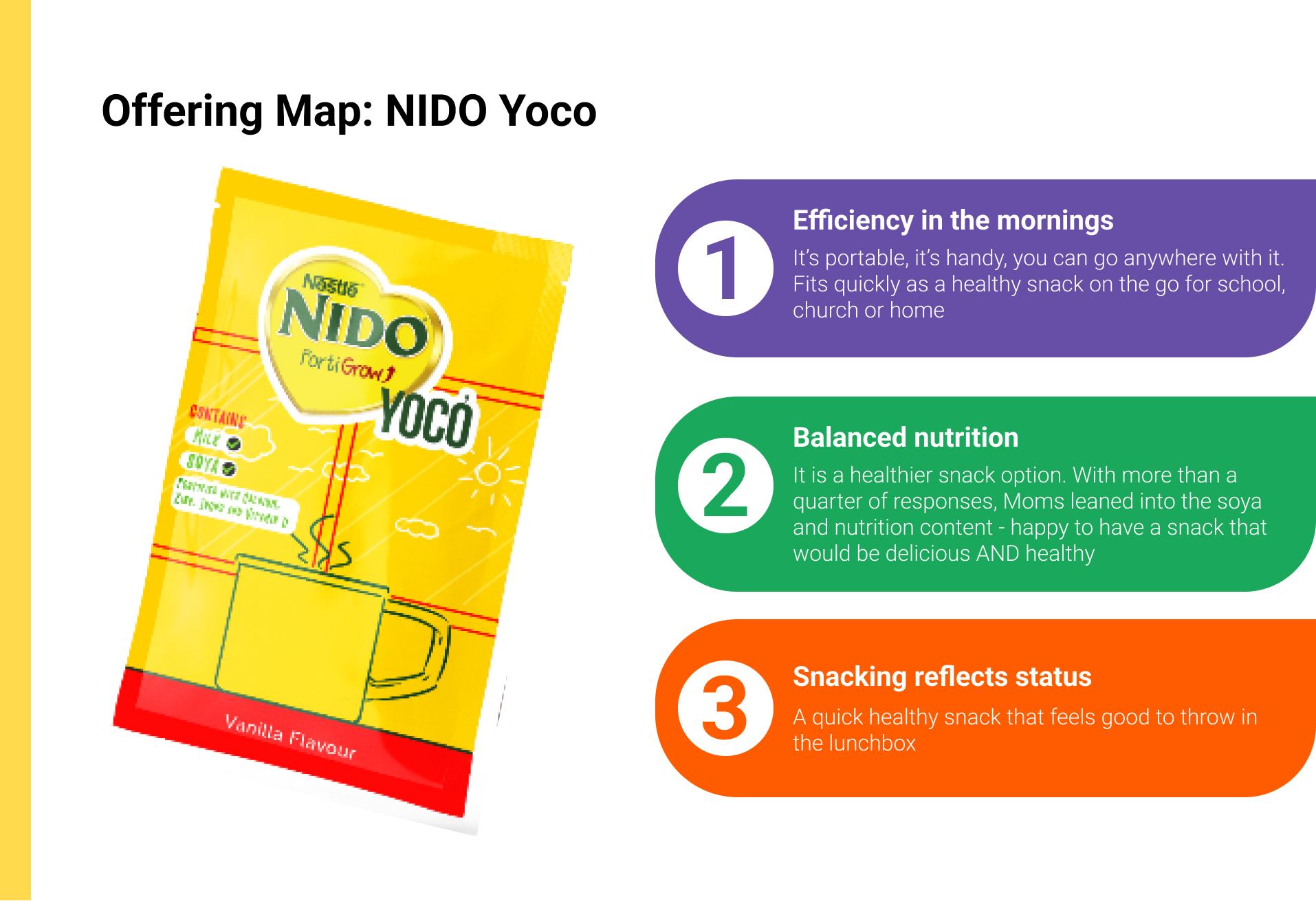

1. Mornings are all about Efficiency

The ideal solution must give huge time and energy efficiencies to mothers who are doing quite a lot to prep for the school day.

2. Breakfast = Energy for School

Their dream breakfast solution keeps kids full AND alert for optimal attention and brain performance at school.

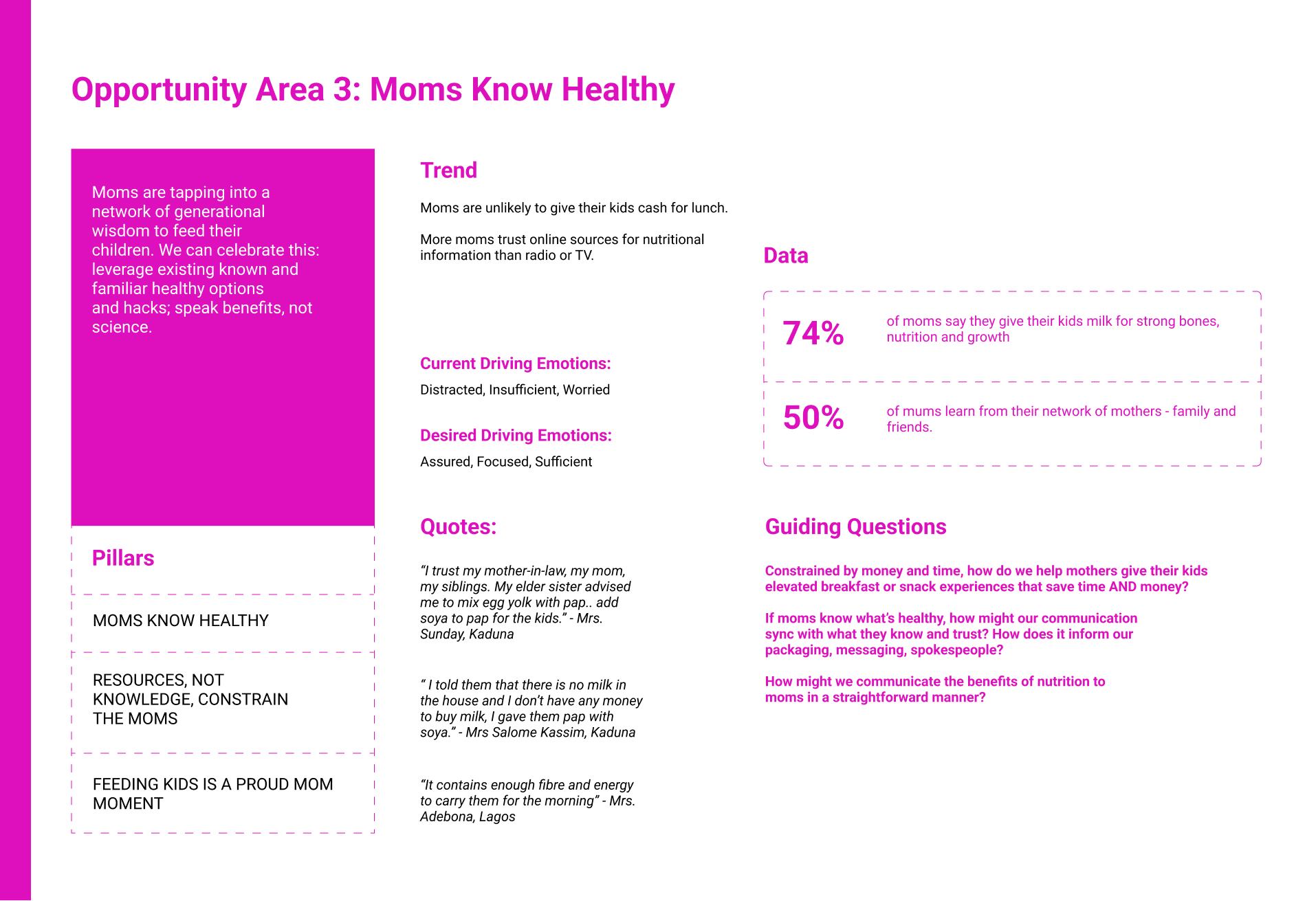

3. Moms know healthy

Moms have a clear understanding of good nutrition and go extra miles to make foods healthier and nutritious. We should highlight the ingredients they know are healthy.

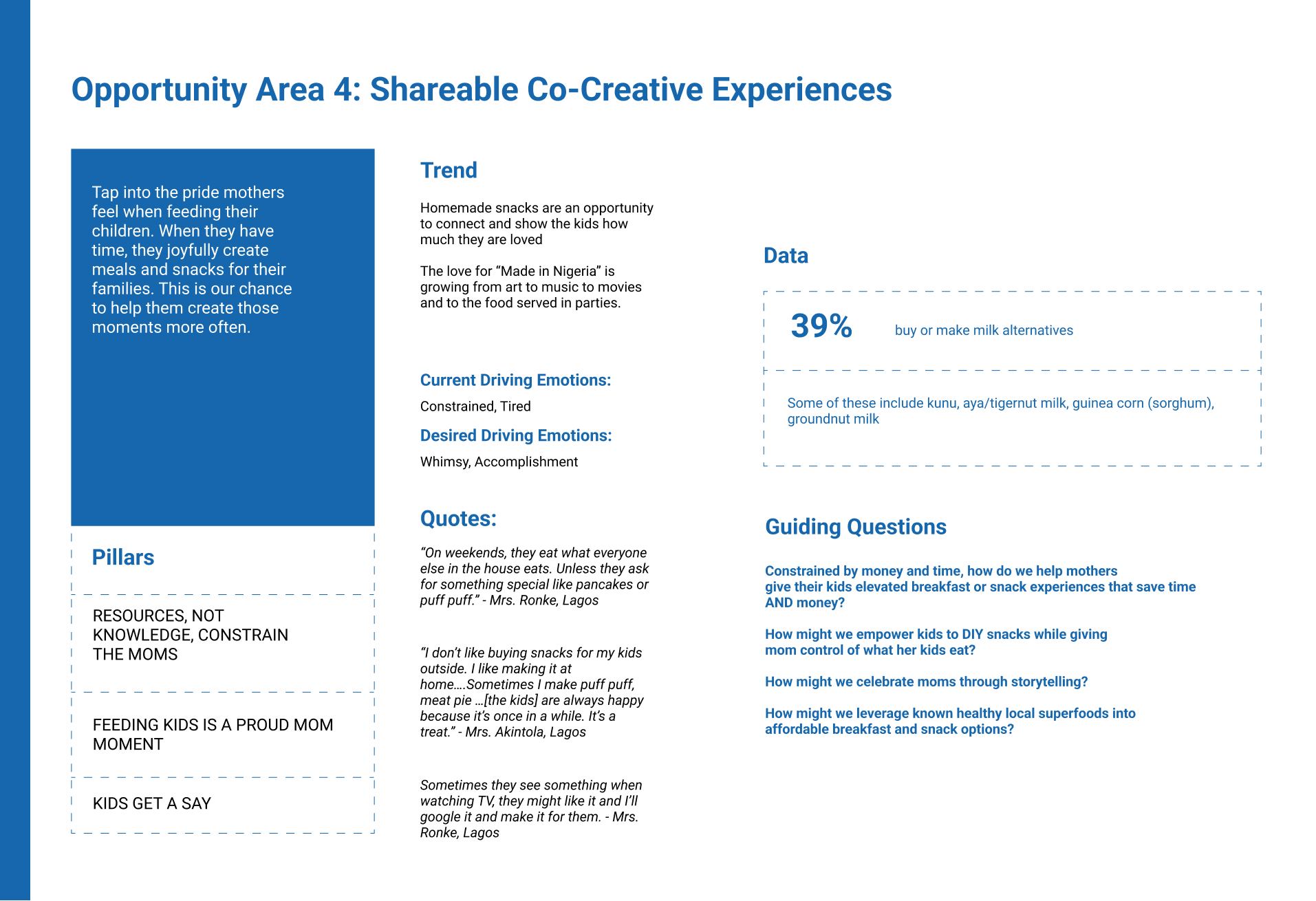

4. Resources, not knowledge, constrain Moms

Despite wanting to go the extra mile, they are often constrained for MONEY and or TIME.

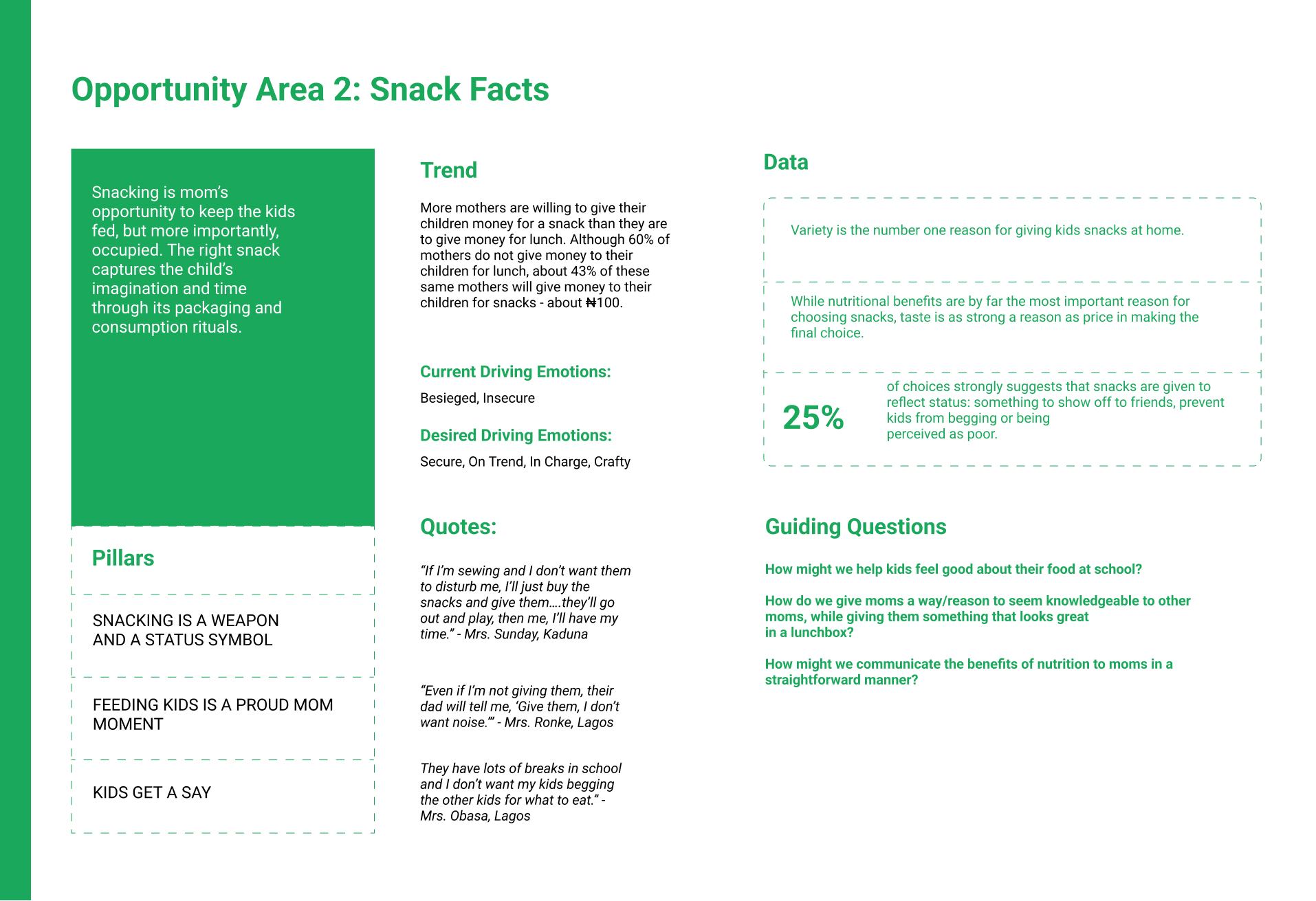

5. Snacking is a weapon and a status symbol

The ideal snack solution must look great in a lunchbox;

entertain and occupy kids; and still be good for them.

6. Feeding kids is a proud mom moment

Moms tap into a generational network to learn about drinks, foods, snacks that are good and nutritious for their kids.

7. Kids get a say

Mothers listen to what their kids want.

Opportunity Areas

OPPORTUNITY AREA 1

How might we make breakfast quick to prepare, filling without slowing kids down, yielding high brain performance for school?

OPPORTUNITY AREA 2

Snacking is mom’s opportunity to keep the kids

fed, but more importantly, occupied. How might

our snack capture the child’s imagination and

time through its packaging and consumption

rituals?

OPPORTUNITY AREA 3

Moms are tapping into a network of generational

wisdom to feed their children. How might we

celebrate this: leverage existing known and familiar

healthy options and hacks to speak benefits, not

science?

OPPORTUNITY AREA 4

How might we tap into the pride mothers feel

when feeding their children? When moms have

time, they joyfully create meals and snacks for

their families. How might we help them create

those moments more often?

Ideas & Testing

Using our opportunity areas as a launchpad, we had our second round of workshops to ideate about 200 concepts in 2 hours to then converge to 7, fully developed prototypes. These prototypes were tested in 3 focus groups with 4 mothers each coming from 2 cities of Nigeria - Abuja and Lagos. Based off desirability, feasibility and scalability factors of these ideas, we converged towards 3 iterated concepts that were tested in the second round of focus groups.

The ideas were prototyped by the product team, and I created visual mockups to improve the testing experience for people in the focus groups by communicating the intended look and feel of these products and reducing ambiguity.

Based off the mothers feedback in the second round of focus groups and expertise of local Nestlé staff we moved forward with 2 concepts to be validated through a quantitative survey that was launched to 272 mothers

across Nigeria.

Product Design Principles

Make it time and energy efficient

Solutions must give huge time and energy efficiencies to mothers who are doing a lot to prep work for the school day

Make it tasty, good-looking and entertaining

Their dream breakfast solution keeps kids full AND alert for optimal attention and brain performance at school.

Make it healthy

Tasty nutrition is essential for mothers who run the extra mile to provide nutritious food to their kids.

Base it on a diversity of local nuts and grains

Mothers show a higher preference towards nuts and grains compared to fruits.

Product Description

YoCo is a creamy breakfast beverage made with a blend of milk, soya, and sugar. It is very filling and rich in nutritional value. There’s no need to add milk or sugar. It saves you time and money.

Simply add hot water to transform the powder into a creamy, buttery, naturally sweet drink that requires no additional milk or sugar.

YoCo is packed with nutritional benefits for growth, strong

bones as well as Zinc, Iron and Folic Acid for good brain

development. Delicious, creamy milk and soya for your children.

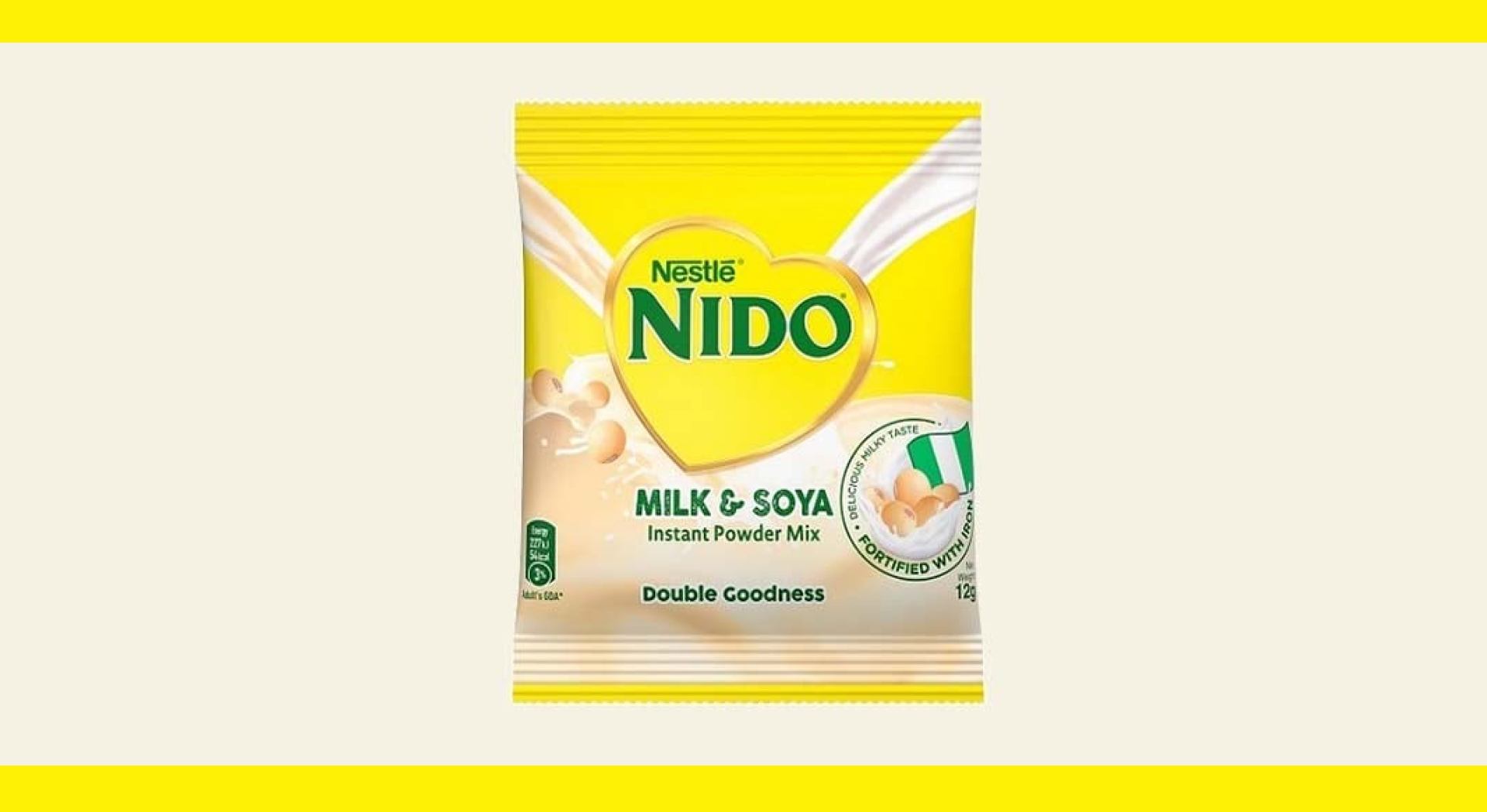

Final Product

In the first quarter of 2024, Nestlé launched the Milk & Soya instant powder mix. It is described on the company’s website as their first affordable and nutritious instant powder in Central and West Africa, made with a blend of milk and plant ingredients.

Credits

Design

- Anietie Brendan

- JR Kanu

- Toks Fagbamigbe